Top of the morning.

Investing used to be slow, boring, and, most importantly, very different from gambling. Today, the same app that holds your life savings can also sell you meme-stock mania, 0DTE “lotto tickets,” and leveraged ETFs that turn normal market moves into gut-punch swings.

Let’s get into it →

Free 30-minute portfolio check-up

Worried about losing money when investing? You’re not alone.

In just 30 minutes, we’ll look at where you are now (cash, existing investments, or just ideas) and walk through how a simple, quality-focused approach to investing could work for you.

Gambling with Your Portfolio: Don’t Fall Into The Trap

Written by Camille

Are you investing or gambling?

Investing is a responsible thing. It’s what you do when you have a job and a future and you would like the money you earn to quietly turn into more money over time. It’s productive. You are “allocating capital.”

Gambling, meanwhile, is a slur. Even people who like it tend to defend it on the grounds that it’s fun, a form of paid entertainment, not a sensible wealth-building strategy. And everyone agrees on the basic math: in aggregate, it’s negative for your wallet. The house always wins.

When gambling lives in its designated habitats (casinos, betting shops, online bookmakers), the categories stay nicely separated. You send money to the bookmaker and you basically assume it’s gone. If some of it wanders back into your bank account later, that’s a pleasant surprise, like finding a twenty-pound note in an old coat.

But the line gets blurry when the financial industry lets you gamble from the same app where you hold your life savings, using products that look like investing because they come wrapped in the language of markets.

The dynamic described above becomes explosive once you add one ingredient: human nature.

Financial independence is very appealing. It means you can quit a job you hate, move somewhere quieter, or start the business you keep talking about.

The problem isn’t to want this. The problem is when people want this by next Friday.

We live in an economy that is very good at taking that desire and putting it on a treadmill. The attention business runs on dopamine and comparison. You open an app to see your friend’s holiday, or a stranger’s “just made $40k this week trading” screenshot explaining that the only thing separating you from wealth is that you haven’t found the right “system” yet. It creates the sense that the world is full of people getting rich quickly, and you are simply choosing not to.

People often compare themselves to peers on social media

Nobody posts “I bought a biotech stock and now I have a valuable lesson about risk management.” People only see success stories, ignoring the vast majority who fail, creating a false sense of normalcy for rapid riches.

On top of that, many lack understanding of traditional wealth-building, making them susceptible to "secret formulas" or "hustle culture" promises. This is where experience matters.

If you tell a professional investor, someone who has spent a decade watching thousands of very serious companies fight for every extra percent of return, that you have a fool-proof method for compounding at 60% a year, they would laugh at your face. A young professional just out of university might lap it up and start dreaming about sports cars.

When you combine impatience with tools that look like investing, you get a predictable outcome: people start using the market the way they use a casino. Here are three of the most common ways it shows up.

Your brokerage app is the new casino

1. Event trading

Ever since Gen Z and millennials became the clients to win over, brokerages stopped trying to look like mahogany-and-marble institutions and started looking like apps. And apps have a pretty well-understood business model: keep you engaged.

“Top movers.” Streaks. Push notifications that basically say come on, just check the price real quick. It’s not subtle.

“Event contracts” are a good example: you can take positions on all sorts of outcomes: earnings results, a Fed decision, and also, somehow, sports. Which team wins the 2026 World Cup, which player gets the most rebounds in Knicks–Lakers, etc. If you think that sounds like gambling but with a brokerage account, trust your instincts.

Event contracts allow users to bet on in-game outcomes

The more insidious version is what people do when they trade stocks and ETFs around events. You’re making a two-layer bet: first, what will happen; second, what will everyone think about what happened. It’s not uncommon to see a company beat market expectations and the stock price falling.

That isn’t investing. It’s a binary outcome, you win or you lose, and either way the house brokerage collects its fees.

2. Leveraged ETFs

An even more dangerous form of undercover gambling is the leveraged ETF, because it comes disguised as the most wholesome product in finance: the regular ETF.

Regular ETFs are great. They are managed for you, and they allow you to easily make a diversified investment into a geography/industry of your choice. This is why the most repeated advice in personal finance is also the best: keep buying an index fund, steadily, for a long time. It’s not exciting. That’s kind of the point.

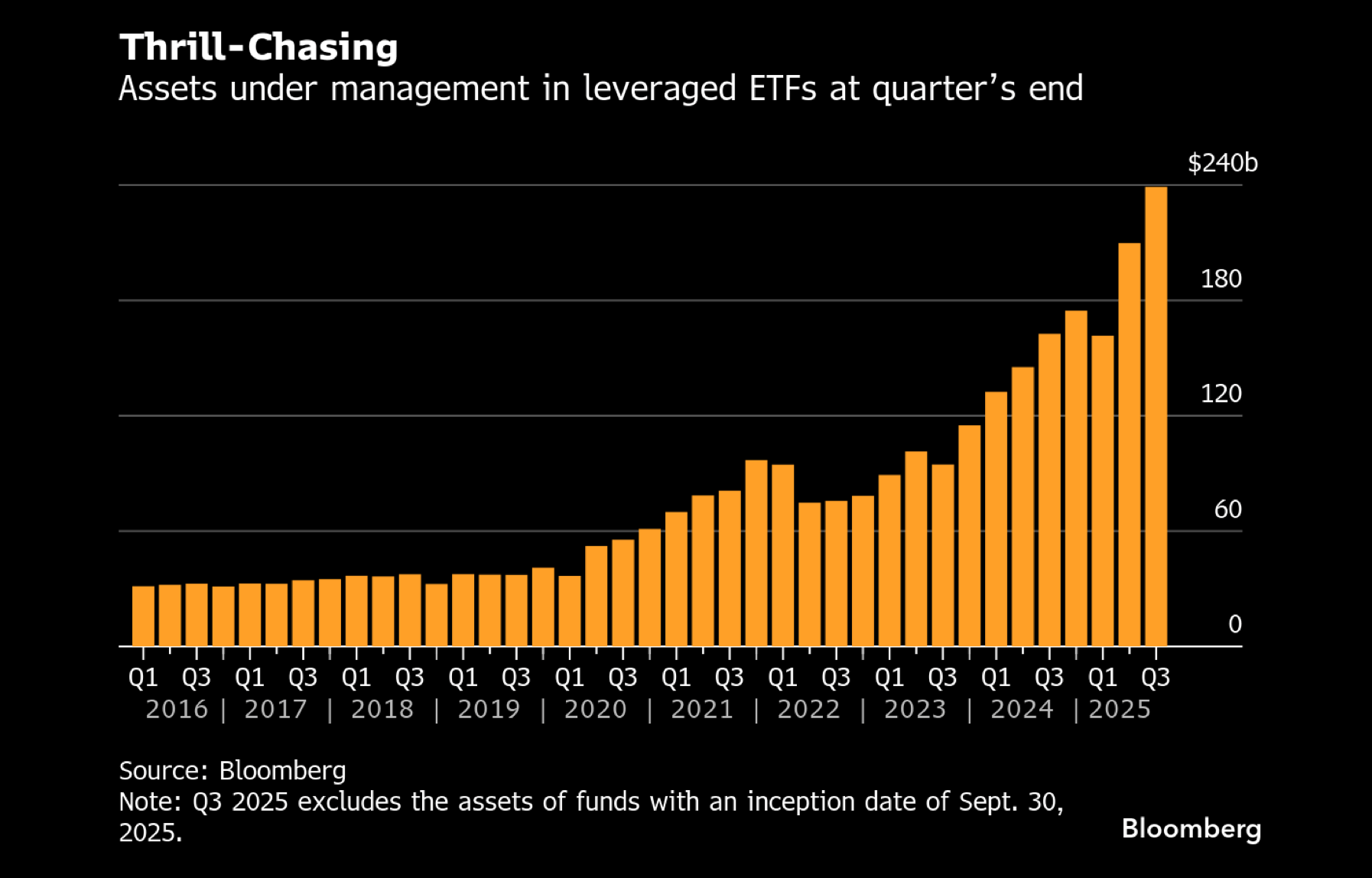

Enter the 3x leveraged ETF. Conceptually it’s the regular ETF, but turned up to maximum volume. If the underlying index is up 1% today, your 3x fund is up about 3%. That sounds fantastic, right up until you remember that the amplification also works in reverse. The elevator goes both ways, and it doesn’t have a brake.

Demand for leveraged ETFs has never been higher

In investing, losses hurt more than gains help. Not just psychologically, mathematically too. If you lose 50% on day one, you need 100% on day two to get you back to where you started.

Leverage makes that asymmetry louder. When you string together a bunch of up-and-down days, which is what markets usually are, the leveraged ETF can end up worse off than you’d expect even if the underlying index hasn’t gone anywhere interesting.

That’s why these are trading tools. They’re designed for short-term bets on direction, which is very different from investing.

3. 0DTE options

This is the lottery ticket equivalent on Wall Street. Buy an option that expires the same day you buy it: “0 Days To Expiration.” They’re basically a bet on what a stock or an index will do in the next few hours.

Because there’s almost no time left, they’re cheap compared to normal options, which makes them feel harmless: you can risk a small amount for the chance of a big payoff. But the tradeoff is brutal. If the market doesn’t move your way quickly, and by enough, the option can go from “up big” to “worthless” in minutes.

Getting rich slowly

When Amazon founder Jeff Bezos asked Warren Buffet in an interview: "Your investing strategy is so simple. Why doesn't everyone just copy you?" Buffett's reply was, "Because nobody wants to get rich slow.”

Warren Buffett has explained why more people don’t invest like him

People don’t fail at investing because they can’t understand it. They fail because they can’t tolerate it. Good investing is the ability to be bored on purpose, to look unimpressed by other people’s overnight wins, and to accept that the path to wealth is, annoyingly, more like gardening than like winning the lottery.

How do you get rich slowly?

Spend less than you earn, and invest the difference, consistently.

Not “when you feel like it.” Not “when the market looks good.” Just the unglamorous habit of turning income into assets, month after month.

Think like a business owner, not a trader.

Focus on fundamentals: what the business does, how it makes money, what does the competition look like, etc. It’s not unrealistic to aim for 15% annual returns.

In the early years, the amount you add matters more than the return you earn. The only realistic way to “accelerate” is to save more and keep feeding the machine. Or, get better annualised returns. That will come from picking very high quality companies at bargain prices.

Start investing on easy mode

The RatedA Portfolio is beating the market. You could too.

Members receive full updates on all our buys and sells, expert insights, as well as carefully selected stock recommendations to help you invest like a pro.

How are we doing against the benchmarks?